Martingore.net:

Actualités et Technologie

Santé et Loisirs

Communauté et Connaissances

Découvrez nos ressources

Notre site web, Martingore.net, offre une gamme variée d’articles, de guides pratiques et de vidéos inspirantes sur une multitude de sujets, allant des dernières tendances en matière de technologie aux conseils de santé et de loisirs.

Informations Générales

Sur Martingore, vous pouvez découvrir une multitude de sujets intéressants tels que l’actualité, la technologie, la santé et les loisirs.

Média Compagnon

Restez connectés avec notre communauté dynamique et participez à des discussions enrichissantes sur divers sujets.

Exploration Ludique

Détendez-vous avec notre section sur les loisirs et découvrez de nouvelles passions.

Point Santé

Restez informé sur les dernières avancées en matière de santé et prenez soin de vous grâce à nos conseils pratiques.

Enrichissement des Connaissances

Avec Martingore, vous pouvez découvrir des informations pertinentes et élargir vos horizons.

Rejoignez notre communauté et élargissez vos connaissances !

Explorez de nouveaux sujets

Retrouvez une variété d’articles sur les dernières actualités, les avancées technologiques, et les tendances en matière de loisirs.

Optimiser votre bien-être

Trouvez des conseils pratiques pour améliorer votre santé et trouver un équilibre dans votre vie quotidienne.

Echanger des idées

Rejoignez notre communauté dynamique et partagez vos opinions et vos idées sur les sujets qui vous passionnent.

En savoir plus

Explorez nos contenus pour élargir vos horizons dans divers sujets.

Atteindre vos objectifs

Trouvez des guides et des outils pour vous aider à atteindre vos objectifs et réussir dans différents domaines.

Prendre soin de vous et de la planète

Découvrez des conseils pour adopter un mode de vie sain et écologique.

Notre portfolio d’œuvres créatives

Découvrez notre sélection de projets inspirants et plongez dans un monde d’imaginaire.

Nos offres

Découvrez nos offres abordables pour accéder aux meilleurs contenus et rester à jour avec les dernières tendances.

Abonnement Premium

Profitez d’un accès exclusif à nos contenus premium et découvrez les dernières informations en avant-première.

Abonnement Étudiant

Pour les étudiants avides de connaissances, découvrez nos contenus exclusifs à un prix avantageux.

Abonnement Formation

Offre spéciale pour les formateurs et professionnels de l’éducation.

Restez à jour avec les derniers articles, tutoriels et nouvelles sur les sujets qui vous passionnent.

Découvrez les dernières tendances et les informations essentielles dans les domaines de la technologie, de la santé, des loisirs et bien plus encore.

Serflex : guide complet pour choisir le bon collier de serrage

Serflex s’impose comme une référence incontournable pour choisir un collier de serrage fiable et performant. Avec plus de 60[…]

Mobilier restaurant esthétique : créez une ambiance unique

Créer une ambiance unique dans votre restaurant passe par le choix d’un mobilier esthétique. Chaque pièce raconte une histoire[…]

Solutions innovantes en énergie photovoltaïque pour un futur durable

Solutions innovantes en énergie photovoltaïque pour un futur durable Dans un monde où la transition vers les énergies renouvelables[…]

Top offres des banques traditionnelles : analyse comparative 2025

Top Offres des Banques Traditionnelles : Analyse Comparative 2025 Si vous cherchez à comprendre les meilleures offres des banques[…]

Panneau photovoltaïque : une satisfaction client remarquable

Le recours aux panneaux photovoltaïques ne cesse de croître, et pour cause : la satisfaction des clients atteint des[…]

Énergie renouvelable : comment réduire vos factures avec le solaire

Maîtriser vos dépenses d’énergie tout en optant pour une solution écologique, c’est possible grâce à l’énergie solaire. Que ce[…]

Energie photovoltaïque : des solutions pour un avenir meilleur

L’énergie photovoltaïque représente bien plus qu’une simple solution énergétique. C’est une opportunité d’évoluer vers un avenir durable, face aux[…]

Organisez un evjf inoubliable avec un escape game captivant

Organisez un EVJF Inoubliable avec un Escape Game Captivant Qu’est-ce qu’un Escape Game et pourquoi choisir cet activité pour[…]

Découverte quotidienne : 10 chasses au trésor ludiques à essayer

Êtes-vous à la recherche d’une manière amusante et engageante de pimenter votre quotidien ? Pourquoi ne pas essayer une[…]

Comparatif banque traditionnelle : guide des meilleures offres

Choisir une banque traditionnelle peut sembler complexe avec la multitude d’offres disponibles. Cet aperçu complet vous permet de comparer[…]

Découvrez l’excellence en gestion locative à Pau avec Alter Immo

Si vous cherchez à optimiser la gestion de vos biens immobiliers à Pau, il est essentiel de se tourner[…]

Découvrez les bienfaits de l’algue rouge pour votre peau

Vous avez probablement déjà entendu parler des bienfaits des algues pour la santé, mais saviez-vous que l’algue rouge peut[…]

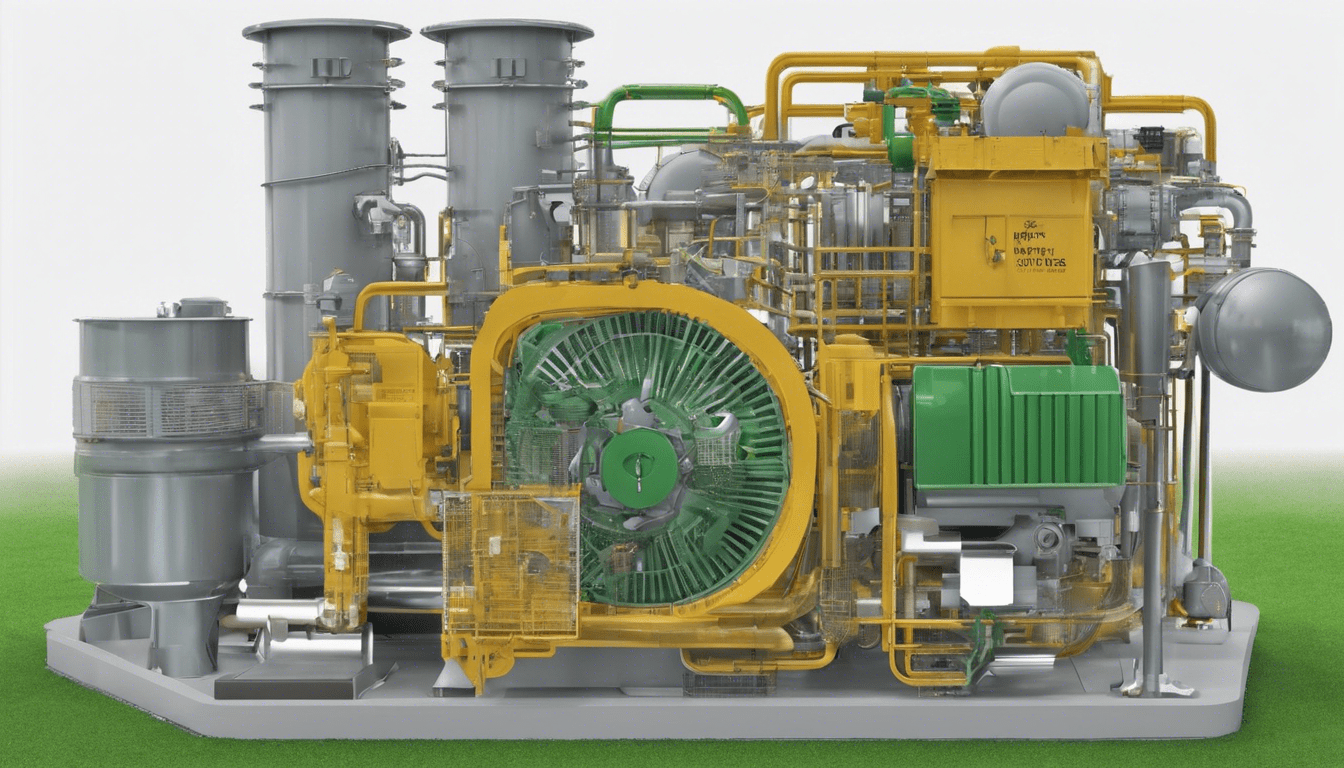

Économisez de l’énergie et profitez des avantages fiscaux des moteurs à biomasse

Vous cherchez des moyens d’économiser de l’énergie tout en profitant des avantages fiscaux ? Les moteurs à biomasse pourraient[…]

Comment sont frappés les Napoléons en or ?

La monnaie est à la fois un objet du quotidien et une relique de l’histoire économique. Au cœur de[…]

Nettoyage de façade et toiture : comment assurer la sécurité pendant les travaux ?

Le nettoyage de façade et de toiture est une étape cruciale dans l’entretien et la valorisation de votre patrimoine[…]

Comprendre les droits des places handicapé en parking privé

Naviguer les nuances des droits des places handicapé en parking privé peut sembler complexe, pourtant, c’est essentiel pour garantir[…]

Comparateur d’assurance habitation : un outil pour vous aider à trouver la meilleure compagnie

Découvrez comment un comparateur d’assurance habitation peut devenir votre meilleur allié pour économiser sur les primes et choisir la[…]

Comparatif valise soute: quelle est la meilleure?

Lorsque vient le moment de préparer ses affaires pour un voyage, le choix du bagage s’avère crucial. Entre le[…]

Photographe à Marseille : pourquoi choisir un shooting en studio ?

Marseille, ville d’art et de lumière, offre des décors extérieurs à couper le souffle, pourtant opter pour un shooting[…]